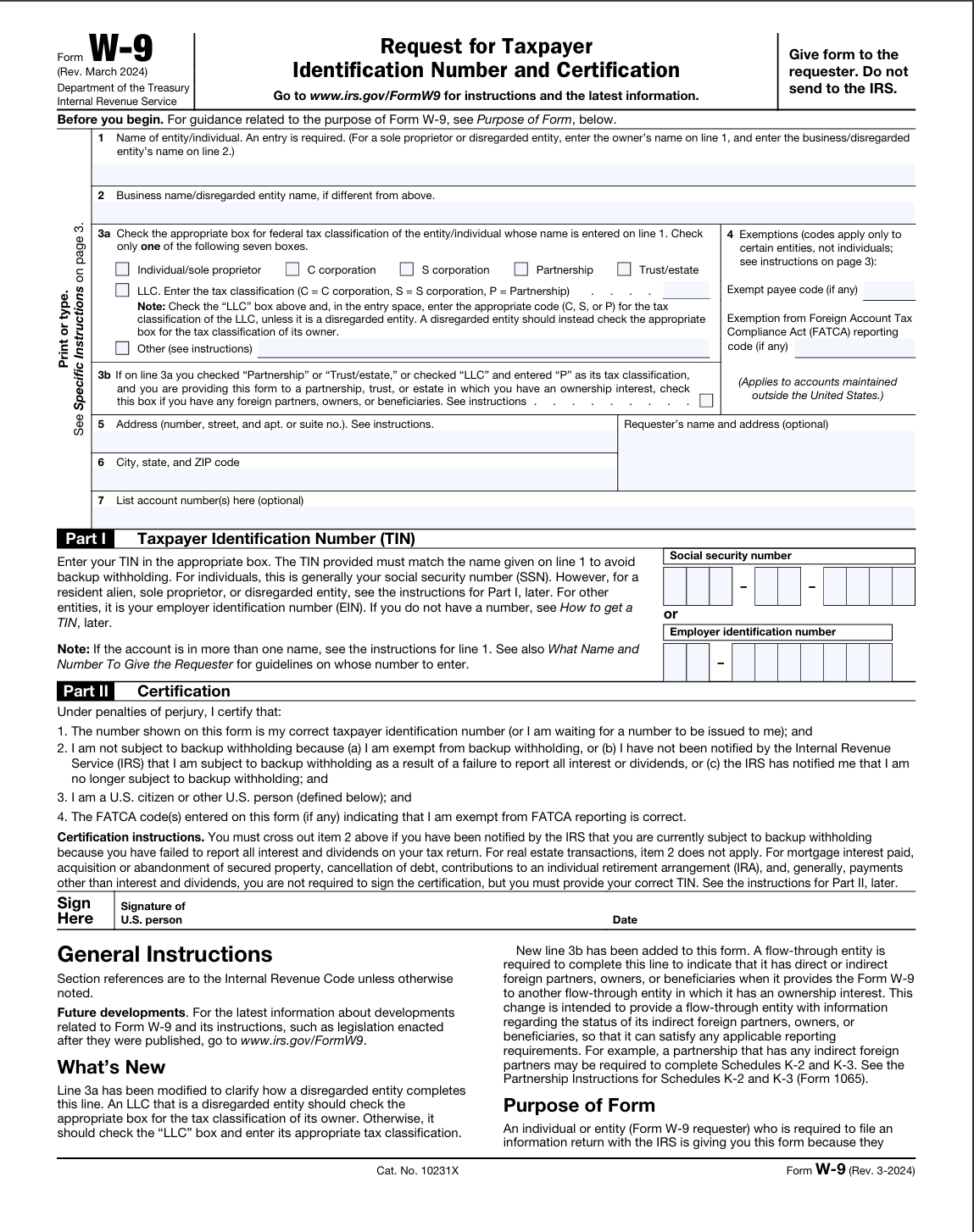

The W-9 form, officially known as the “Request for Taxpayer Identification Number (TIN) and Certification,” is a crucial document used by businesses to collect information from independent contractors they hire. This form helps businesses accurately report payments made to these contractors to the IRS. However, it’s easy to make mistakes when filling out a W-9, which can lead to complications and even penalties. Here are some of the most common errors to avoid:

1. Incorrect Name and TIN:

-

- Name: Ensure the name you enter on Line 1 matches the name on your Social Security card (for individuals) or your business’s legal documents.

- TIN: Your TIN can be either your Social Security Number (SSN) for individuals or an Employer Identification Number (EIN) for businesses. Double-check that you enter the correct number.

2. Wrong Business Classification:

- On Line 3, you must select the appropriate federal tax classification for your business. This could be individual/sole proprietor, C corporation, S corporation, partnership, etc. Choosing the wrong classification can lead to tax reporting issues.

3. Leaving Lines Blank:

- Make sure you complete all the required lines on the form. Leaving out information like your address or business name (if applicable) can invalidate the form.

4. Not Updating the Form:

- If your information changes (e.g., you change your business name or address), you need to submit a new W-9 form to anyone who has requested one from you.

5. Not Signing the Form:

- Although not always mandatory, signing the W-9 form is generally recommended as it certifies that the information you provided is accurate.

By being aware of these common pitfalls and carefully reviewing all information before submitting a W-9, you can ensure accurate tax reporting and avoid potential issues with the IRS. Taking the time to double-check your information now can save you time and headaches later.