W9 Form 2025 – If you’re a freelancer, independent contractor, or a business owner, understanding the W-9 form is essential for managing your tax responsibilities. This form is crucial for ensuring that all parties comply with IRS regulations when it comes to reporting income.

Key Takeaways

- The W-9 form is used to collect taxpayer identification information from freelancers and independent contractors.

- It is essential for businesses to report payments made to contractors on the 1099-NEC form.

- The W-9 requires personal information such as name, address, and taxpayer identification number.

- A W-9 is necessary when a contractor is paid $600 or more in a calendar year.

What Is a W-9 Form?

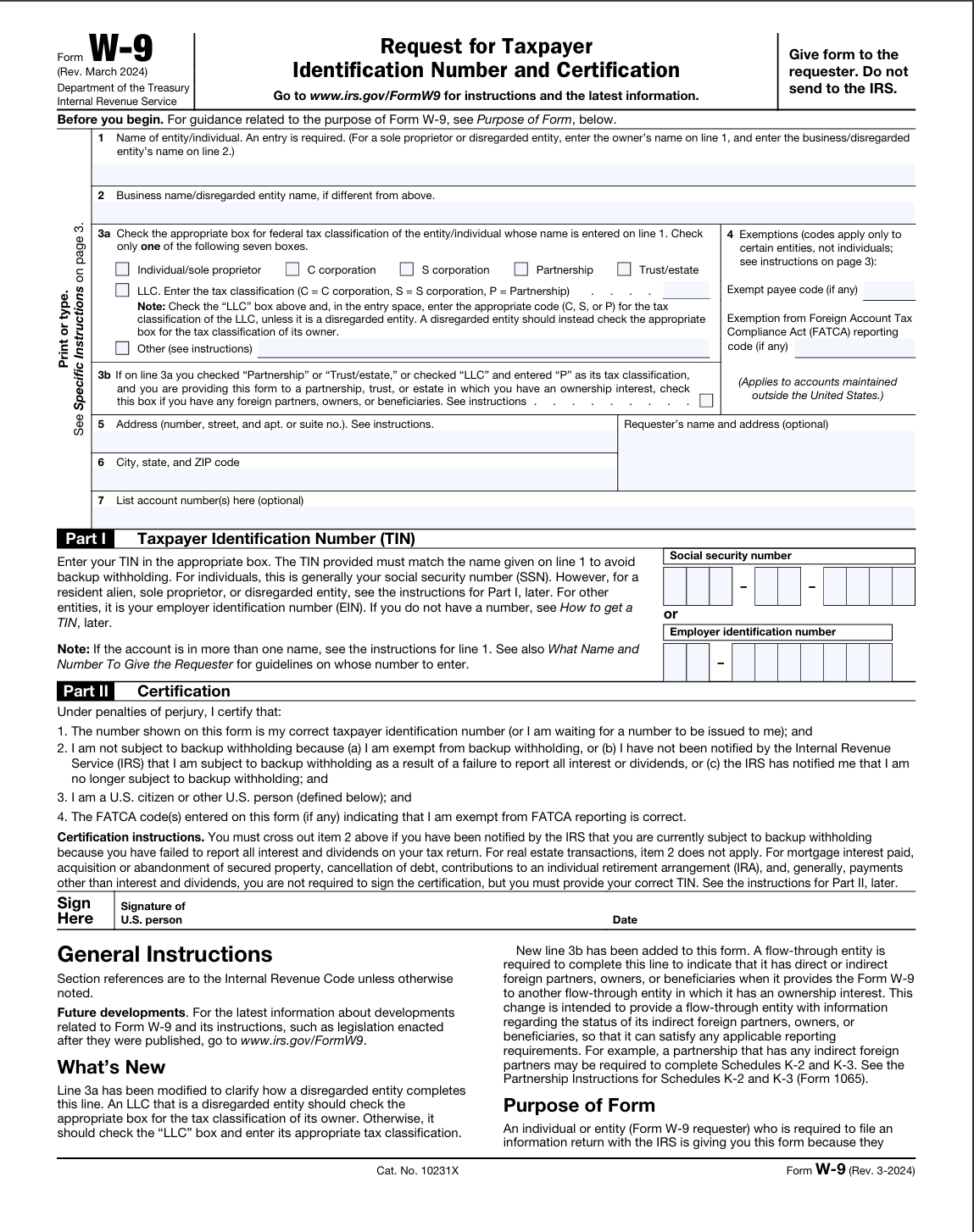

The W-9 form, officially known as the “Request for Taxpayer Identification Number and Certification,” is a document used by businesses to obtain the correct taxpayer identification information from individuals or entities they pay.

Save and Print w9 form 2025 Printable Free for freelancers

Purpose of the W-9

- Tax Reporting: The information collected on the W-9 form is used to prepare the 1099-NEC form, which reports non-employee compensation to the IRS.

- Compliance: Ensures that both the payer and payee are compliant with tax laws.

When Is a W-9 Required?

- A W-9 is required when a business pays an independent contractor or freelancer $600 or more in a year for services rendered.

W-9 Form Essentials for Independent Contractors and Freelancers

If you’re an independent contractor or freelancer, here’s what you need to know about the W-9 form.

Completing the W9 Form 2025

- Simplicity: The W-9 form is straightforward to fill out. It typically takes less than five minutes to complete.

- Multiple Clients: You do not need to fill out a new W-9 for each client. Keep a copy handy for quick submission.

When Not to Fill Out a W-9

- Sensitive Information: Only complete a W-9 if you trust the requester and understand why they need your information.

- Employee Status: If you are an employee, you should fill out a W-4 instead of a W-9.

Updating Your W-9 Form in 2025

You should update your W-9 if:

- Your name or address changes.

- Your federal tax classification changes (e.g., from sole proprietor to LLC).

- You receive a notice from the IRS regarding backup withholding.

W-9 Form Essentials for Business Owners

As a business owner, understanding the W-9 form is crucial for managing payments to contractors.

Requesting a W-9

- Before Payment: Always request a W-9 from independent contractors before making payments.

- Record Keeping: Keep the completed W-9 on file for your records; you do not need to submit it to the IRS.

Handling Missing W-9 Forms

- If a contractor does not provide a W-9, document your attempts to obtain it.

- You may still file a 1099-NEC, noting that the contractor refused to provide their taxpayer identification number.

Foreign Contractors

- Foreign vendors should complete a W-8 form instead of a W-9.

FAQs About the W-9 Form

Who Needs a W-9?

- Any individual or business that is paid $600 or more in a year for services should provide a W-9.

Tax Implications of a W-9

- The amount of tax owed depends on various factors, including income level and deductions.

When Is a W-9 Not Needed?

- A W-9 is not required if payments are less than $600 or not business-related.

What If a Vendor Does Not Provide a W-9?

- Document your attempts to collect the W-9. If you fail to obtain it, you may face penalties for incomplete reporting.

The W-9 form is a vital tool for freelancers, independent contractors, and business owners alike. Understanding its purpose and requirements can help ensure compliance with IRS regulations and streamline the tax reporting process.